ESPN broadcasts about a third of all women’s sports shown on TV, and Chairman Jimmy Pitaro is a big reason why. Now, it’s going to cost him.

Women’s sports have soared in popularity since ESPN parent Walt Disney Co. bought the rights to televise a package of college events in 2011 and professional basketball in 2014. More than 10 million people tuned in to watch the April championship basketball game between Louisiana State University and the University of Iowa. The WNBA opener on ESPN drew the biggest cable audience for a regular season game in 24 years.

All that enthusiasm is likely to drive up the value of those broadcast rights. ESPN agreed to pay an estimated $34 million a year for about 20 women’s NCAA sports back in 2011. Now the basketball final included in that deal is likely to be valued at $100 million alone when the current contract expires next year, according to a report commissioned by the league. WNBA rights, which come up in two years, are set to soar as well, by some estimates.

In an interview, Pitaro acknowledged that ESPN will probably have to pay up to keep popular properties — and that the network put itself in that position with its expansion and promotion of the programming. ESPN has spread women’s sports to more than a dozen platforms, from cable TV to the ESPN+ App, increasing the audience and helping advertisers gain reach. Last year, that translated into 33,000 hours across 18,000 programs.

“We know that the more we invest, the more we grow the leagues, the harder it’s going to be for us to renew,” Pitaro said. “From my perspective, that’s a high-class problem.”

Pitaro credits the first-ever WNBA fantasy league as an example of new ideas that ESPN has used to expand interest. And the changes are seen well beyond high-profile sports such as women’s March Madness or the WNBA, he said. ESPN televised about 200 regular season women’s college softball games and made an additional 2,600 available on digital platforms. The network also carried every postseason game and the Women’s College World Series. There are also ESPN-affiliate networks dedicated to popular college divisions, such as the Southeastern Conference and Atlantic Coast Conference.

The network estimates it has a thousand advertisers supporting women’s sports, according to Rita Ferro, head of advertising for Disney. “That's everything from WNBA to college sports and up and coming sports,” she said in an interview.

ESPN made the most of its women’s sports slate at this month’s upfront presentations, an annual event where networks pitch their upcoming programs to advertisers. With a writers strike halting production of TV dramas and comedies, ESPN’s parent Disney emphasized the strength of live events.

Angel Reese, the key player in LSU’s NCAA victory over Iowa, made a cameo appearance for ESPN at the Javits Center in New York, as did WNBA star Breanna Stewart. Serena Williams took to the stage to discuss an upcoming documentary on her life in tennis set to air on ESPN+.

ESPN isn’t the only broadcaster increasing its coverage of women’s sports, and competition will be a key factor in setting the value of broadcast rights in the next round of contracts. Fox Corp. airs NCAA women’s basketball now and is teaming up with Comcast Corp.’s Telemundo to carry women’s World Cup soccer this summer. NBC, also part of Comcast, will air 450 hours of women’s golf this year and have Big Ten’s women’s basketball on the Peacock streaming service next season. CBS airs the National Women’s Soccer League, the WNBA and women’s golf. Amazon.com Inc. streams some WNBA games and has documentaries in the works.

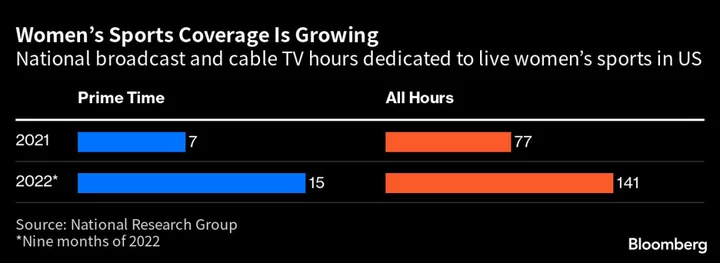

“Everybody agrees the rights fees will go up and should go up,” said Jay Kaufman, head of sports at the National Research Group and a former NBA executive. “You’re dealing with some pretty significant numbers and it’s not just the top tier sports. Things like college softball and volleyball, they’re also putting up some pretty significant numbers.”

“Significant” is still a relative term, he added. A report from the National Research Group last year showed outlays exclusively for women’s sports amounted to just 0.2% of the total spent on sports rights in the US. On the men’s side, NBA broadcast rights alone may more than double to $8 billion a year, according to Bloomberg Intelligence. It will be a long time before women’s broadcast rights get more than 2% to 3% of the share, Kaufman said.

Some observers, such as Ed Desser, president of the rights negotiating company Desser Media Inc., say the women’s college basketball playoffs should be split off from other women’s sports to extract the most value. Women’s March Madness alone could be worth than $100 million a year if sold on its own, according to the 2021 NCAA report that he worked on.

The NCAA has retained a media consultant to aid in future rights negotiations for the basketball championship and other postseason events, and says it’s open to “any and all creative ideas.” The NBA didn’t respond to requests for comment on the WNBA contract.

When negotiations for the next rounds of rights start, Pitaro will make the case that the infrastructure ESPN has built for women’s sports, spanning 17 platforms, will support the properties’ future value. Still, he says ESPN will have a budget.

“We know we can’t have everything,” Pitaro said. “We may not have the same exact properties as we have today. We will continue to do the deals that make the most sense for ESPN and Disney.”

--With assistance from Gerry Smith.