Billionaire and former hedge fund manager Leon Cooperman has taken a late stake in Manchester United, the football club that’s nearing the end of a yearlong bidding war.

Cooperman reported a position of just under 1 million shares currently valued at $16.8 million, according to a recent filing. With a net worth of $2.6 billion, according to the Bloomberg Billionaires Index, Cooperman is the founder of New York-based Omega Advisors who converted his hedge fund firm into a family office in 2018.

Last month, a Qatari group led by Sheikh Jassim Bin Hamad J.J. Al Thani withdrew its offer to buy Manchester United, paving the way for British billionaire Jim Ratcliffe to eventually gain control of the storied football club.

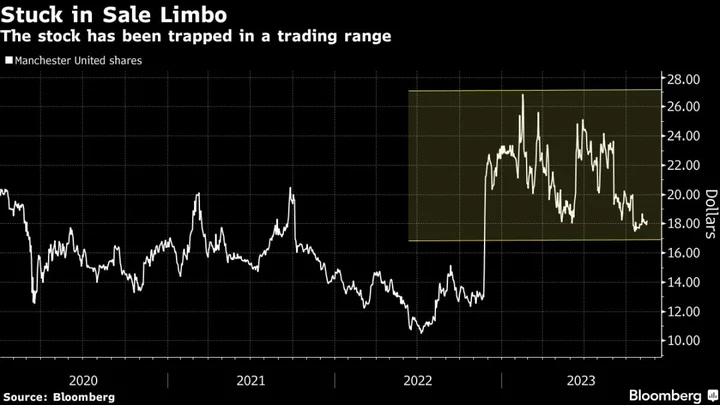

Funds have been betting on the outcome of the Manchester United sale process, which was officially kicked off by the Glazer family a year ago. At times, the bidding war was closer to a frenzied Premier League deadline day or NFL draft than a billion-dollar deal, and has caused the club’s share price — listed in New York — to be highly volatile.

The stock rose as much as 2.3% on Tuesday in New York.

Read More: Cooperman Says Making $400,000 Doesn’t Mean You’re Wealthy

Filings from earlier this year revealed a number of hedge funds, including Psquared Asset Management AG and Antara Capital, took stakes in the club. Bloomberg News reported in September that Ratcliffe was restructuring an offer for Manchester United to address concerns from minority holders — which include the likes of Lindsell Train, Ariel Investments LLC and Eminence Capital — about being excluded from any deal.

“I will oppose anything that gives the majority Glazers a materially better deal than minority investors,” Eminence Capital founder Ricky Sandler told Bloomberg. “That is for sure.”

Eminence, the hedge fund founded by Sandler in 1999, manages about $6 billion of assets, and is the third-largest shareholder of Manchester United, according to data compiled by Bloomberg.

Sign up for Bloomberg’s Business of Sports newsletter for the context you need on the collision of power, money and sports, from the latest deals to the newest stakeholders. Delivered weekly.

--With assistance from Lynn Thomasson.