Washington in northeast England likes to boast of its US connections. George Washington’s ancestral home lies at the heart of the old village; the family coat of arms greets visitors to the municipality; even the local golf club is named after the first US president.

Yet for all the historic affinities, government actions in the US capital now pose a threat to the economic lifeblood of its diminutive English namesake.

Up the road from Washington is the UK’s largest car plant, run by Nissan Motor Co. of Japan. How long that can remain viable is unclear as a result of President Joe Biden’s policies that are upending the auto industry from Germany to South Korea.

At the heart of Biden’s new industrial policy sits the Inflation Reduction Act (IRA), which envisages $369 billion of government support for clean technologies including electric vehicles and the batteries that power them.

It’s escalated a race for state-backed subsidies that risks leaving the UK adrift, struggling to match the kind of money on offer elsewhere to spur the transition, while exposing ongoing post-Brexit frictions over access to its main European Union market. Already the signs are ominous.

As of mid-March, European battery cell manufacturers had announced plans to add 581 gigawatt-hours (GWh) of production capacity on the continent, according to BloombergNEF, which researches the energy transition. Add in non-European battery makers, and the figure rises to some 1,100 GWh by 2026.

The UK equivalent so far is about 12 GWh at a single site: a “Gigafactory” Nissan is building near Washington. The government has offered subsidies for a further battery plant at a new Jaguar Land Rover site in southwest England and an announcement could be imminent.

Yet conversations with current and former British auto executives reveal a sense of alarm at how the UK government has dawdled in the face of overwhelming competition. They point to a damaging series of errors and handicaps that have undermined the industry over years, from high energy costs and a supply chain that’s overly dependent on China to a lack of the political and economic stability that companies need to make key business decisions.

Delays in responding to the IRA risk compounding those missteps, they say, and if unaddressed may be the death knell for an industry whose history is strewn with defunct marques once synonymous with the heyday of British engineering.

“Continuing decline is all that’s written on the horizon,” said Ian Gibson, who joined Nissan as an executive as the company built its Washington plant in the mid-1980s and later ran its European business. Biden’s policy simply creates “a new focus to speed that” downward trajectory, he said. “If the UK market is isolated from the EU in its response to the US, then we just get squashed between the two.”

The challenge posed by the IRA is also focusing renewed attention on the UK’s decision in a 2016 referendum to quit the EU. It finally left the bloc of 450 million people in 2020, but the EU remains by far the largest single destination for its cars, accounting for 45% of all UK production in 2022.

Stellantis NV is among carmakers that have called on the UK government to renegotiate the Brexit deal to revise so-called rule of origin requirements. As of next year, 45% of the value of a car must be sourced in the UK or the EU if it is to be sold on the other side of the Channel without a 10% export tariff. From 2027, the threshold will rise to 65%.

The maker of Vauxhall and Peugeot brands said in a submission to a UK Parliament inquiry in May that rising costs of energy and raw materials mean it is unable to meet the rules of origin as set out in the Trade and Cooperation Agreement struck with the EU.

Warning of insufficient battery production supplies in either the UK or continental Europe, Stellantis said if the cost of electric vehicle manufacturing “becomes uncompetitive and unsustainable, operations will close.”

Nissan, the largest carmaker in the UK, accounts for some 30% of production. It’s said assembling cars in Britain is at risk of simply becoming too expensive after the rules are implemented.

The UK government says it will soon announce a solution on the post-Brexit trading rules. It’s also working on a so-called advanced manufacturing plan aimed at keeping carmakers in the UK, Business and Trade Secretary Kemi Badenoch said.

The strategy “should be a way of helping to corral a little bit more — in terms of not just support but more streamlined policies — about what we’re going to do in order to make sure this industry survives,” Badenoch said in an interview at the Qatar Economic Forum in Doha on May 23.

A large part of that survival rests on the success of the £1 billion ($1.2 billion) electric car hub now under construction between Washington and Sunderland. It includes a plant to make batteries for Nissan’s latest generation of vehicles, adding to a smaller 1.7 GWh plant the company already operates.

For a region of high deprivation that voted for Brexit, there’s a lot riding on it. The project is financed by Nissan and Japan-based battery maker Envision AESC each putting in about £450 million, while Sunderland City Council and the UK government committed £50 million apiece, according to Graeme Miller, the council leader. It is scheduled to start operating in 2025, employing 1,000 people.

The facility already resembles an airport serving a medium-sized city, with huge grey hangars and the skeleton of a terminal building. Production is envisaged to grow to as much as 40 GWh by 2030. The challenge for politicians is to ensure it remains viable once it opens, said Miller, a member of the opposition Labour Party who represents an area of Washington.

“What the government hasn’t done is come up with a business strategy,” Miller said in his office at Sunderland City Hall, which has a view to the car plant and the wind turbines that power it. At a time when both the US and China are making EV inroads, the government in London needs to prioritize it, he said. “We’re putting at risk the whole UK car industry.”

Vast as the complex is, it’s dwarfed by other projects in Europe. Sweden’s Northvolt AB has just opted to build a second plant in Germany rather than in the US, with an annual capacity of 60 GWh, enough to power about 1 million EVs. The government in Berlin pledged some €1 billion ($1.1 billion) to lure Northvolt, and the more than 3,000 jobs it promises.

France is nurturing a “battery valley” in the north of the country with plants worth about €10 billion already announced by companies including Taiwanese producer ProLogium Technology Co. Scandinavia has its own battery makers, as does Italy. According to BNEF, $32 billion has been committed to nine European battery firms since the start of 2021.

The numbers in the US are even more striking. Manufacturers there have announced more than $120 billion in EV and battery investments in the last eight years, but almost 75% of that amount came after the first plank of Biden’s industrial policy was enacted around 18 months ago; 42% of that sum was announced since Congress passed the IRA in August, a March report by the Environmental Defense Fund found.

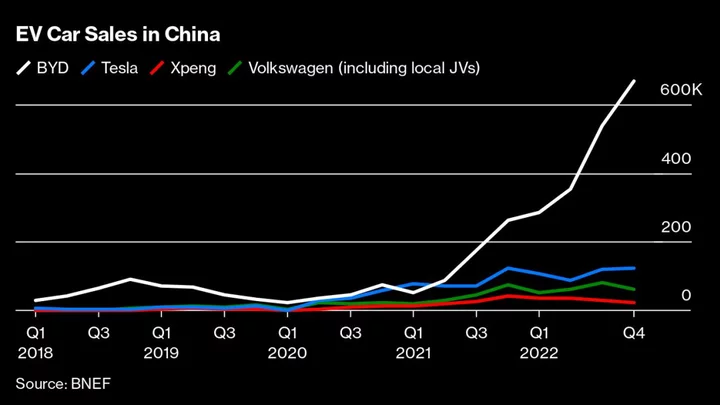

China, meanwhile, already boasts the world’s biggest EV battery maker, Contemporary Amperex Technology Co. Ltd., serving the world’s largest car market, where EV maker BYD Co. is projected to displace Volkswagen as the country’s leading car brand by the end of this year.

For Andy Palmer, the former chief executive officer of Aston Martin who now chairs Slovak battery maker InoBat, the IRA was a reaction to the “amazing progress” of electric vehicle and battery manufacturers in China, and now European governments are responding with comparable action. For the UK, it’s “very late” but not yet too late to act, said Palmer.

The scale of the challenge was laid bare by the experience of Britishvolt, which went bankrupt in January after failing to win investors or the government funding it requested, taking with it half the capacity the UK planned to have online by the end of 2030.

“You’ve got to decide as a government whether your auto industry is critical to you or not, and the 800,000 people who are employed in the auto industry,” said Palmer, who also was chief operation officer at Nissan. “If the answer is yes, then the UK government has to find comparable incentives.” He put the figure at some £3-£4billion.

Prime Minister Rishi Sunak is tamping down expectations, however, saying on May 23 that “subsidy races that essentially just shift capacity between allies in some kind of zero-sum competition are not appropriate.”

Key will be whatever the government provides to encourage India’s Tata Group, the parent of Jaguar Land Rover, to locate its battery plant in Somerset rather than in Spain. JLR is the UK’s second-biggest car manufacturer, and Badenoch said the government was doing everything it could to show Tata that the UK was the best place to invest.

“If the JLR factory comes through, the UK is going to be okay,” said Michael Dean, senior analyst for the European automotive industry at Bloomberg Intelligence. “In terms of the visuals, the UK really needs this.”

Together with Nissan, it still only accounts for about 60% of present production.

The auto industry’s plight is now feeding into the political arena, with the main opposition Labour Party using it as a cudgel to beat Sunak’s Conservatives as it seeks to build on its polling lead going into elections expected later next year. One day after Sunak expressed skepticism over state aid, Labour’s finance spokesperson, Rachel Reeves, was in the US capital praising the IRA as she presented her plan to emulate elements of it.

“The Conservative government’s lack of a comprehensive industrial strategy is jeopardizing the future of our industries, potentially leading them to move abroad instead of staying here,” said Sharon Hodgson, the Labour member of parliament whose district includes the Nissan plant.

In truth, successive governments have played their part in the long decline of Britain’s car industry. The UK is still associated with Formula One motor racing and luxury brands like Bentley. But 1970s labor disputes, poor quality models and underinvestment sowed the seeds for mass-market brands such as Austin, Morris and later Rover to disappear.

The arrival of Japanese carmaker Nissan revolutionized the industry. In 1984, the company agreed with Margaret Thatcher’s government to open the plant by Washington. On offer was a skilled workforce and unfettered access to Europe’s single market, which Britain had joined a little over a decade earlier.

By 1999, the UK was producing 1.79 million cars a year — a third of Germany’s output, but still closer to its heyday. By the time the UK formally left the EU in 2020, production was below 1 million vehicles. Last year, when output in Germany was recovering post-pandemic, it slumped further to 775,000 units.

The stark reality, according to Palmer, is that the UK was the second-largest manufacturer of cars globally in the 1950s and is now in 19th slot. “I think that speaks for itself,” he said. Former Nissan executive Gibson, who started at Ford Motor Co. in the UK in 1969, said the country basically “blew it.”

The question now is whether the UK is equipped to make the transition from a 120-year-old technology it once dominated.

Darren Jones, the chair of the House of Commons Business and Trade Committee, said the UK needs to strike a deal with the US to mesh with its subsidies agenda while also ensuring it has a battery supply chain in place. “Other countries are doing it on steroids,” said Jones, a Labour Party MP. “We’re still at the starting line.”

That fact alone may represent the biggest hurdle to the UK industry’s shift into the world of EVs, and so to its continued existence. The danger is that the government takes so long to respond that other locations get the investment, according to Mike Hawes, chief executive of the UK’s Society of Motor Manufacturers and Traders. “It’s not too late,” Hawes said, “but the window is closing fast.”

--With assistance from Stephanie Flanders, Siddharth Vikram Philip and Julian Harris.